Good insurance is a form of financial protection that helps you mitigate the impact of unexpected events, such as accidents or illnesses, by covering your costs or compensating you for losses. In the context of education, a good insurance policy can offer peace of mind to parents and help them provide their children with a quality education, even in difficult circumstances.

Why is good insurance important for parents of school-going children?

- Protects against financial loss – A good insurance policy helps parents manage the costs of unexpected events, such as a child’s illness or injury. This can help prevent financial strain and allow parents to focus on their child’s recovery, rather than worrying about how they will pay for it.

- Offers peace of mind – Having good insurance can give parents peace of mind, knowing that they are prepared for the unexpected. They can focus on their children’s education and well-being, without worrying about the financial impact of unexpected events.

- Ensures that education is uninterrupted – A good insurance policy can help cover the costs of tuition fees and other school expenses in the event of a parent’s death or disability. This helps ensure that a child’s education is not disrupted and that they can continue to receive a quality education.

- Provides support in difficult times – A good insurance policy can provide support to families during difficult times, such as the death of a parent or the onset of a serious illness. This can help ease the financial burden and allow parents to focus on their child’s well-being.

When choosing an insurance policy, it is important for parents to consider their specific needs and the coverage offered by different policies. Some key factors to consider include the policy’s coverage limits, the cost of premiums, and any exclusions or limitations.

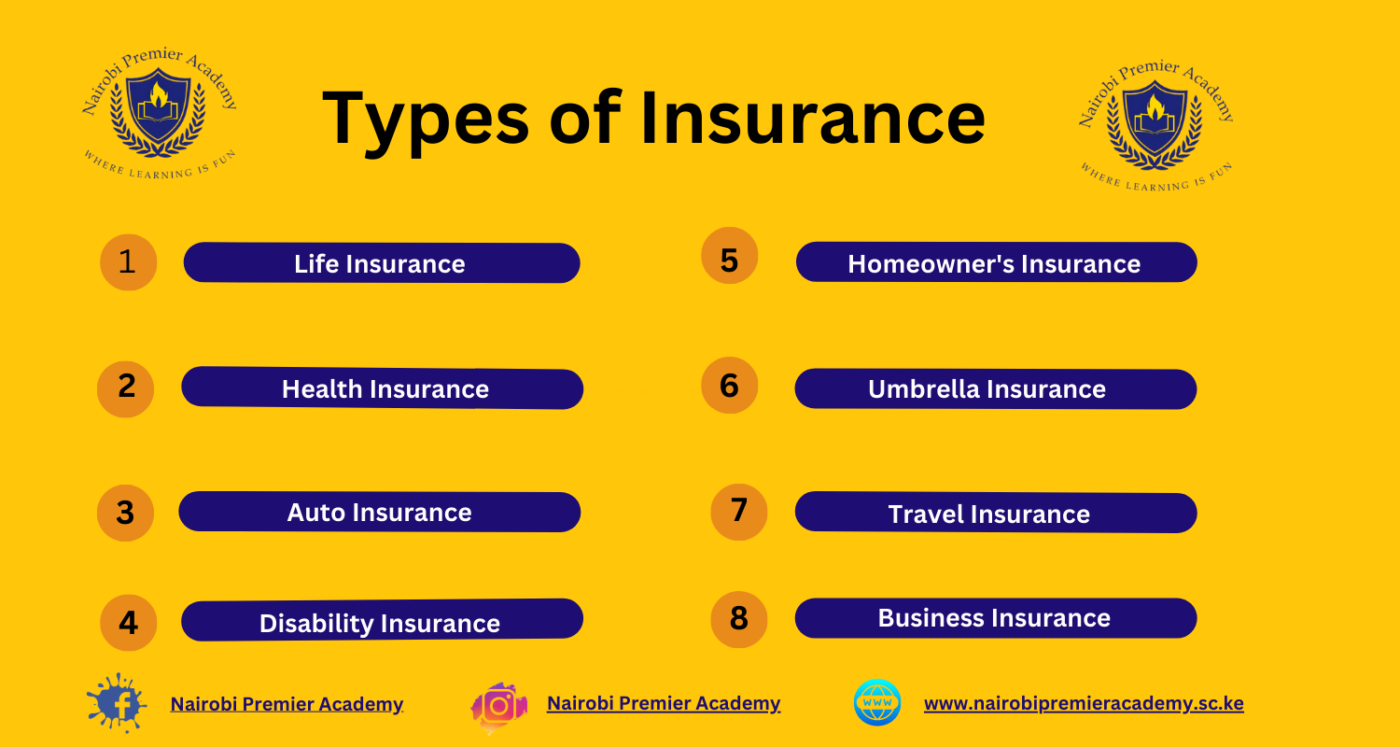

Types of Insurance

There are several types of insurance policies available, each designed to meet different needs and provide protection against specific risks. Here are some of the most common types of insurance:

- Health Insurance: Health insurance provides coverage for medical expenses incurred as a result of illness or injury. This type of insurance is essential for everyone, as medical bills can quickly become expensive.

- Life Insurance: Life insurance provides financial protection for your loved ones in the event of your death. It can help to cover the cost of funeral expenses, outstanding debts, and provide a source of income for your family.

- Auto Insurance: Auto insurance provides coverage for damage to your vehicle, as well as liability coverage in the event of an accident. This type of insurance is usually mandatory for drivers.

- Homeowner’s Insurance: Homeowner’s insurance provides coverage for damage to your home, as well as personal liability coverage. This type of insurance is usually mandatory for homeowners with a mortgage.

- Disability Insurance: Disability insurance provides financial protection in the event that you become unable to work due to illness or injury. This type of insurance can help to cover living expenses, medical bills, and other expenses while you are unable to work.

- Umbrella Insurance: Umbrella insurance provides additional liability coverage over and above the limits of other policies, such as auto or homeowner’s insurance.

- Travel Insurance: Travel insurance provides coverage for unexpected events that may occur while you are traveling, such as trip cancellations, medical emergencies, and lost or stolen luggage.

- Business Insurance: Business insurance provides coverage for risks associated with running a business, such as property damage, liability, and loss of income.

The type of insurance policy you choose will depend on your specific needs and risks. It’s important to carefully consider your coverage options and speak with an insurance agent to determine the right policy for you.

Components of Good Insurance

Good insurance typically consists of the following five components:

- Adequate coverage: This refers to the amount of insurance you have in relation to your assets, liabilities, and risks. Adequate coverage protects you from financial loss in the event of a covered event.

- Reasonable premiums: Premiums are the cost of insurance coverage. A good insurance should have premiums that are reasonable, affordable, and consistent with the level of coverage provided.

- Financial stability: Good insurance should be provided by a financially stable company that has the resources to pay claims. Look for an insurance company with a good credit rating and a history of paying claims promptly.

- Customer service: Good insurance companies should have responsive and helpful customer service representatives who are available to answer questions and assist with claims.

- Fair claim settlement practices: Good insurance companies should have fair claim settlement practices that ensure that claims are processed quickly, fairly, and in accordance with the terms of the insurance policy. Look for an insurance company with a good reputation for settling claims fairly and promptly.

In conclusion, here is a list of 10 companies offering the best insurance coverage:

State Farm:

- State Farm is a leading insurance company providing a wide range of insurance products, including auto, home, life, and health insurance.

- Website: State Farm

Allstate:

- Allstate is a prominent insurance company offering various insurance products such as auto, home, life, and business insurance, known for its personalized coverage options.

- Website: Allstate

Geico:

- Geico is well-known for its auto insurance offerings, providing competitive rates and emphasizing an easy-to-use online platform for obtaining quotes and managing policies.

- Website: Geico

Progressive:

- Progressive is a major auto insurance provider, recognized for its innovative policies and tools, aiming to simplify the insurance process for customers.

- Website: Progressive

USAA:

- USAA primarily serves military personnel and their families, offering a wide array of financial services and insurance products.

- Website: USAA

Aflac:

- Aflac specializes in supplemental insurance, providing policies that offer cash benefits to policyholders for accidents, illness, disability, and more.

- Website: Aflac

Liberty Mutual:

- Liberty Mutual is a globally recognized insurance company offering a range of insurance options, including auto, home, renters, and life insurance.

- Website: Liberty Mutual

Nationwide:

- Nationwide is a well-established insurance company offering a wide range of insurance products, including auto, home, life, and business insurance.

- Website: Nationwide

Travelers:

- Travelers is a leading property and casualty insurer, offering various insurance solutions for individuals and businesses, including auto, home, and business insurance.

- Website: Travelers

Chubb:

- Chubb is a global insurance company known for providing specialized insurance solutions, including personal and commercial coverage, often catering to high-net-worth individuals.

- Website: Chubb

For the most accurate and up-to-date information about their coverage and services, please visit the respective company websites.

An interesting discussion is definitely worth comment. I do believe that you should publish more about this subject, it may not be a taboo matter but typically people dont discuss these subjects. To the next! Many thanks!!

We will definitely purpose to delve deeper into the conversation. Thank you for your feedback. *MNN

What are the common misconceptions or myths about insurance coverage for protecting your child’s future, and how can they be debunked?